Bini Mary Easow, Senior Architect

(Revenue Management),

SunTec Business Solutions

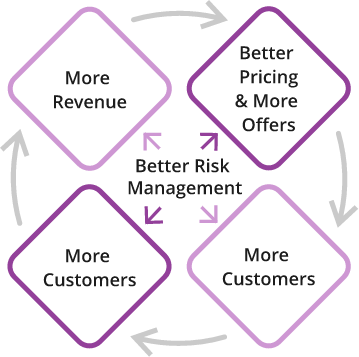

BNPL is short-term financing for comparatively smaller amounts. It is interest-free and seamlessly integrated with the checkout process, making it attractive for customers. Most importantly authorization for this option is based on a soft credit check unlike that of credit cards and loans. Merchants too benefit from BNPL as it generates greater customer footfall and business while they get paid immediately and credit risk is owned by the provider.

Revenue for providers comes from merchant fees or commissions collected from each merchant for every transaction. This ranges between 2 percent to 8 percent of the transaction value. It comes from penalties levied on late payments and from interest on repayment. Providers also levy a marketing fee for schemes such as cost-per-click, affiliate marketing services, as well as charging a one-time processing fee to customers. Merchants pay BNPL providers a recurring administrative fee for billing, servicing, and collections. They also get interest from delayed settlements while collecting a pre-closure charge from customers.