Modernize your account analysis process for holistic customer life cycle management

Most U.S. banks have traditionally treated account analysis as the means to fulfill operational needs around pricing and billing. With the right mindset, approach, and solution, it can be so much more. By modernizing account analysis, you can use this as an especially valuable tool for customer acquisition/retention and service differentiation in a highly competitive business environment characterized by increasingly demanding customers, new players, high interest rates, and rapid digitalization.

Many U.S. banks have not harnessed the transformative potential of account analysis yet as shown in the findings of a survey It’s Time to Reinvent Account Analysis, conducted by the American Banker on our behalf in January 2023.

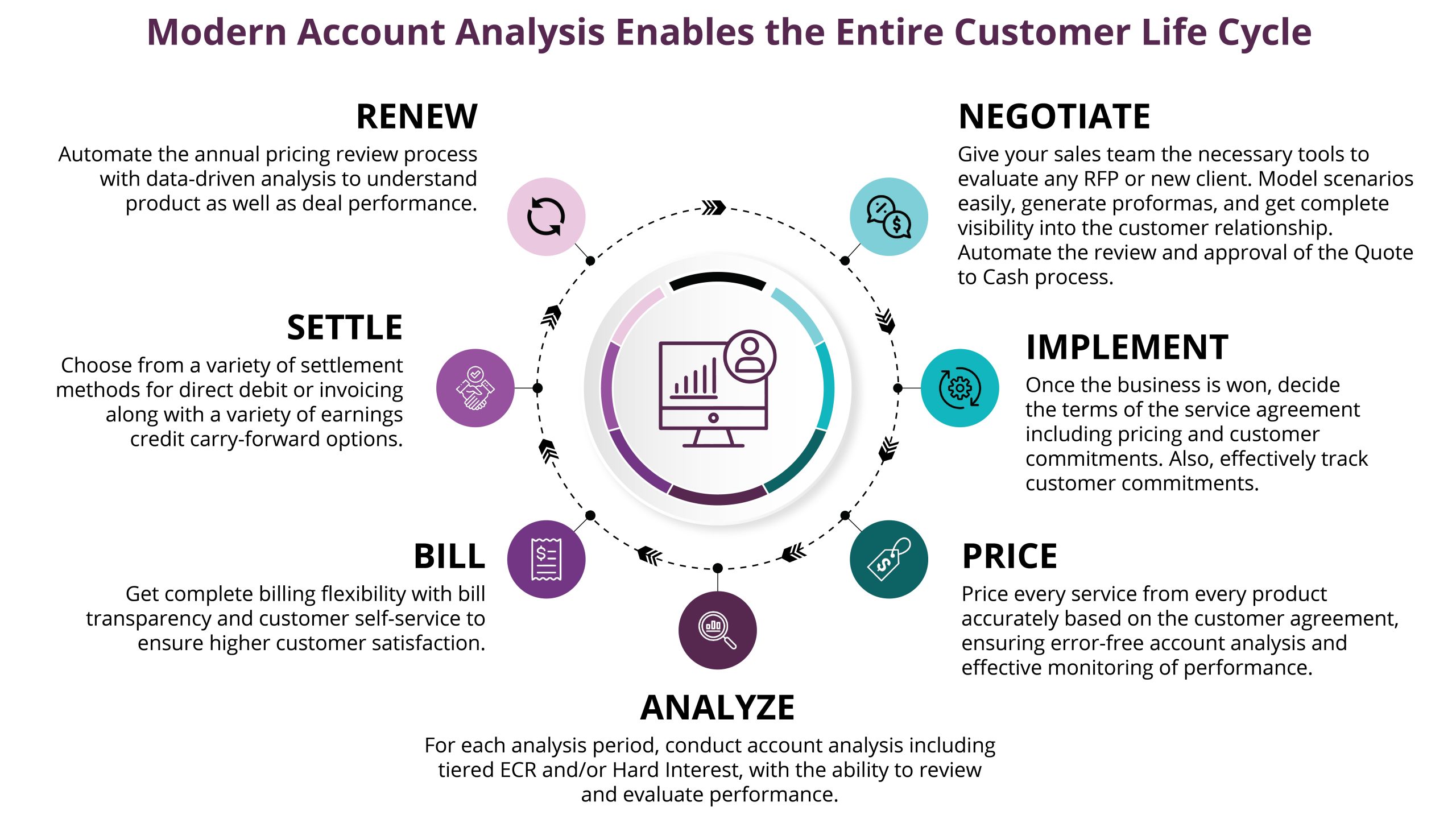

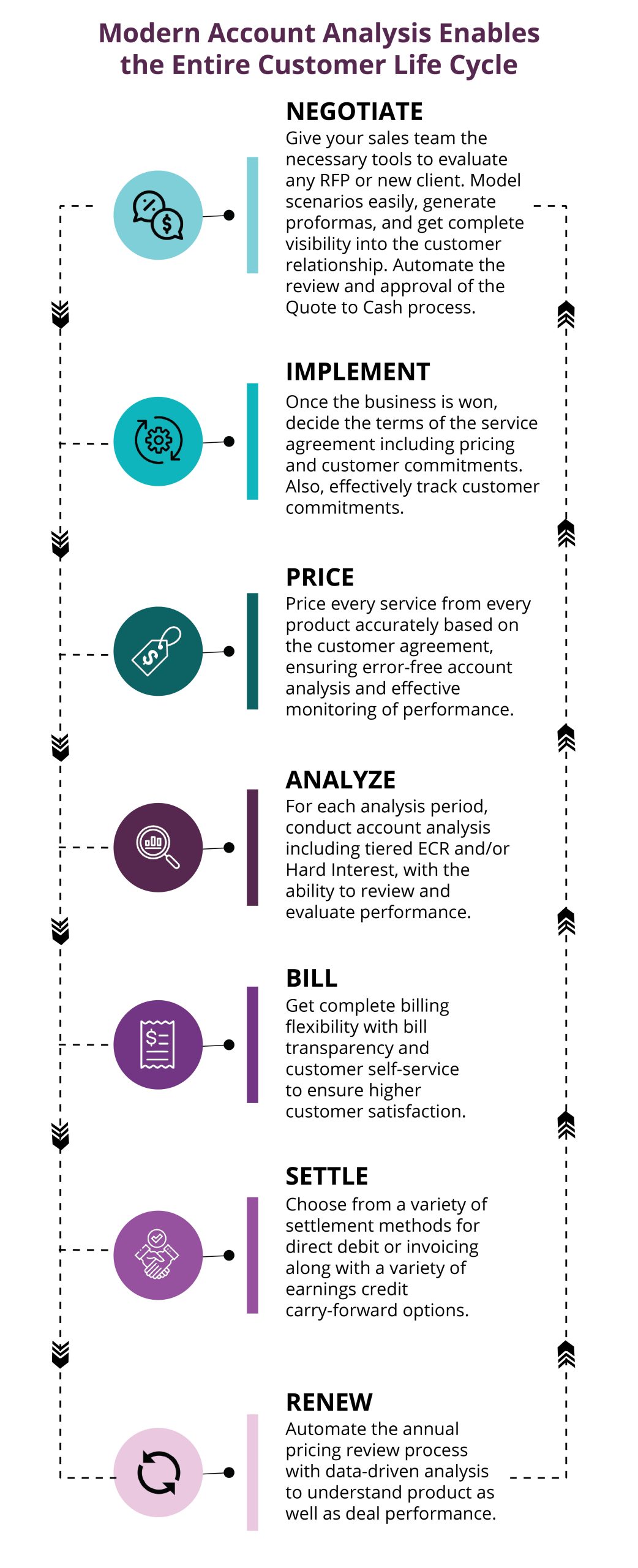

Depending on where in the relationship life cycle a customer is, you can use account analysis capabilities for streamlining various processes such as onboarding, determining prices for services, offering discounts and special process, monthly billing, collections, customer service, issue/dispute resolution, annual price reviews etc. The information available with the bank about each customer can be used to deliver hyper-personalized services.

In essence, our account analysis solution re-invents the entire process to focus on the customer. The result is more satisfied customers, higher customer loyalty, and hence, profitable business growth.

Calculate service charges in nearly unlimited ways (i.e. volume based, value based, balance based and even matrix pricing).

Compete for customer balances with innovative offerings (such as Hybrid Interest, Green ECR, Virtual Accounts).

Generate accurate account analysis statements faster with details on earnings credit, hard interest, pricing of services/products, offsets, discounts etc.

Get the flexibility in billing across business segments to understand significant revenue potential.

Get a single version of the truth (account, customer, product, and bank level) with comprehensive dashboards and workflows.

Manage the entire customer life cycle, from winning the business through implementation, pricing, billing, settlement, annual price reviews, and renewal.

When a customer is onboarded for the first time, pricing is based on expectations of the services that are likely to be consumed, projected volumes, and commitments.

SunTec Account Analysis Solution makes it is easy to automatically adjust prices during the term of the contract based on defined triggers (e.g., end of promotion period pricing or non-achievement of agreed targets). Such changes to pricing are instantaneous (relative to the time needed to make manual changes for multiple customers), thus minimizing the risk of the bank losing revenue.

Renewal of customer contracts must ideally be based on customer-wide hard data for the previous contract period. Often, though, customer account management teams are ill-prepared because they do not have the necessary details (across all geographies, lines of business, product/service etc.). Our solution equips your sales/relationship management teams with the relevant data to help them negotiate more effectively. This reduces the risk that special lower pricing remains the norm, in turn reducing the bank’s revenue and margins. Our account analysis solution allows every individual customer relationship to be viewed and managed holistically, and through a unified workflow, rather than through ad hoc, disjointed processes. This approach also safeguards relationships from the exit of personnel.

Like other businesses, banks too are seeing the value of ecosystem play; creating and participating in ecosystems comprising non-competing businesses to collectively serve customers.

Such a concept can be extended to corporate customers as well through innovative ecosystem design. For example, banks can tie up with carbon offset providers to create ecosystems around green earnings credits. This can help banks attract and retain balances, while also earning additional interest income for their corporate customers.

In a near-zero interest rate regime, corporate customers did not have to worry much about “soft” earnings credit or “hard” interest on balances. But in an environment of high interest rates,

earnings credits matter.

Banks can attract corporate customers with hybrid accounts that benefit customers by reducing the need for frequent sweeps. On the other hand, banks will benefit from the higher interest-bearing balances that customers will have the incentive to maintain. Our account analysis solution makes it easy for your bank to manage such hybrid accounts, while simultaneously giving your customers real-time information to manage balances, cash flows, and floats more efficiently.

To know more about SunTec Account Analysis Solution and how it can potentially help your bank, write to us on [email protected].

For decades, the function of account analysis in American banks has been considered a basic operational tool...

Read More >

In the wake of a challenging few years, U.S. banks are witnessing a resurgence in commercial deposits. After experiencing…

Read More >

‘Account Analysis’ is perhaps the oldest among all the legacy systems that make up many banks today. With every part of banking getting faster and more intelligent, most banks find themselves handing corporate fee billing in the same way that they have for the past fifty years. It is time for Account Analysis to catch up and finally get the modernization it is due.

The business of banking today is rooted in customer centricity and delivering what the customer needs. Banks are also increasingly focusing on ESG as part of their sustainability strategy.