“For decades, companies have been paying lip service to the idea of delighting customers while simultaneously disappointing them. That approach won’t cut it anymore. Recent market shifts have brought us into a new era, one Forrester calls the age of the customer – a time when focus on the customer matters more than any other strategic imperative “– Harley Manning and Kerry Bodine; Outside In: The Power of Putting Customers at the Center of Your Business.

An interesting anecdote to start with would be the online shoe retailer Zappos, a true exponent of focusing on customer experience to start with would be the online shoe retailer Zappos, a true exponent of focusing on customer experience.

The story starts with how Tony Hsieh, the co-founder, and CEO of Zappos, who was with a team of Skechers, a footwear company, dared the latter to call the Zappos customer-care at 11 PM to order a pizza after Tony and the Skechers team had failed to order it from regular pizza shops because it was too late. The Skechers team dialled the Zappos customer-care and explained the situation to the customer care executive. To their surprise, the Zappos customer care executive helped them out with a list of pizza outlets which were open at that odd hour.

This is what true customer experience is all about – always going over, and beyond!

So, what is customer experience? Forbes defines it as the perception the customer has about the brand of a company[1]. This perception builds the trust in the company and this trust grows as it fulfils the brand promise. This perception is valid not just when the customer uses any product or service of the company, but also before and after. Just like the iceberg that hit The Titanic, customer experience is far beyond the interactions or touch points the customer has with the company. It is also the several strata of processes, technologies and other elements that sit below each customer interaction.

How important is customer experience for a company? As per the Forrester Customer Experience Index report of 2018, while the stock prices of the companies with the best customer experience grew by more than 107% from 2007-2014, it was only around 27% for the laggards[2]. We think that is proof enough.

What about the banks? In the case of a bank, true customer experience will happen when the ‘bank of tomorrow’ becomes invisible, intuitive, immersive, and integrated.

In the Forrester’s US CX Index 2018 survey[3], very few come in the Good Category, and most of the top 20 banks are in the OK category with respect to customer experience. It means that the banks of today need to cover a lot of distance to become the ‘bank of tomorrow.’

Banks will be needed in future if only for the fact that they hold a special place in the lives of any customer. Most of the notable events in the life of a customer –The bank of today satisfies the following needs – provide a place to safely store money; facilitate monetary transactions for everyday life; help grow the wealth stored with banks; and provide access to an easy credit system.

In the future, money will become more virtual. Blockchain will facilitate transactions between individuals and business. Growth of wealth will be handled by fin-techs and robots that will use algorithms. Credit may not be a necessity with populist schemes. Then, why will we need banks anymore a home, buying a car, going for an international vacation or marriage – are associated with the exchange of money. Being the circulatory system for this money, banks thus hold a special place.

The banks of tomorrow may like to realize this if they want to deliver a great customer experience. By virtue of this special place, they understand their customer more than any fin-tech or a technology giant and hence are placed in a better position to deliver this great customer experience.

Now that we have established the fact that people will need banks, what are the needs they must deliver, if, in the future, the basic customer needs are already taken care of? In that situation, the ‘bank of tomorrow’ will need to move further above the value tree and become trusted financial advisors and guardians of customers’ identities. By performing these two roles of advisor and guardian in a better fashion, the ‘bank of tomorrow’ can continue delivering their brand promise and ensure a great customer experience.

Let us look at the future of customer experience for banks from different perspectives

- What will be the customer experience of tomorrow and what are the factors driving it?

- What can bank of today do to address this and become the ‘bank of tomorrow’?

Customer Experience of Tomorrow

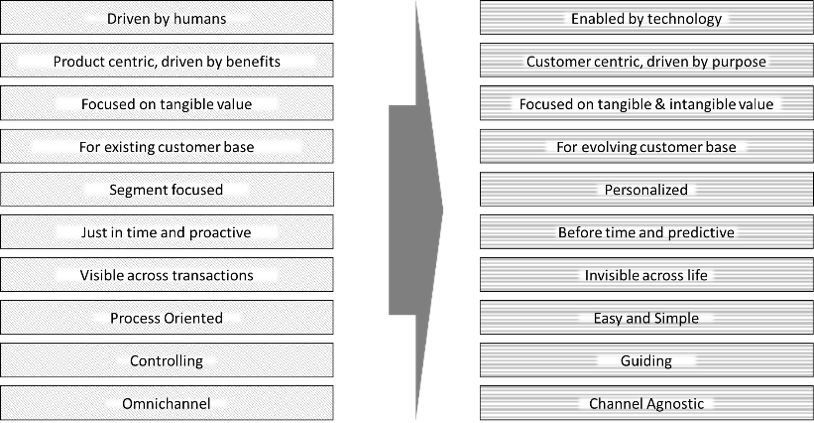

What will the customer experience look like in the future for banks? It will surely look totally different from what it is now. The meaning of customer experience will also change drastically.

Let us create a picture of how the customer experience of tomorrow will shape out for banks.

Enabled by technology

What will the customer experience look like in the future for banks? It will surely look totally different from what it is now. The meaning of customer experience will also change drastically.

Let us create a picture of how the customer experience of tomorrow will shape out for banks.

Today, the customer experience for the bank is enabled mostly by human actions and supported by technology. The customer experience for the bank of tomorrow will be 99% technology enabled and the rest will be human enabled.

During Google’s annual developer conference in 2018, the Google revealed ‘Google Duplex’ to the world. It featured a human sounding robot that called a restaurant and booked a table on behalf of another person. So far so good. But the real twist comes when you learn that the person who took the call at the restaurant did not, at any point of time, know that he was not interacting with a human[4].

In fact, technology is rapidly disrupting customer experience in other industries. As per HBR, ‘Marriott recently teamed up with Amazon to offer a hospitality version of the e-commerce giant’s Echo devices in select hotel rooms.[5]’

It is known that banking is all about a lot of transactions and a lot of interactions. To build the customer experience for the future, banks must realize that not everything can be driven by humans. Digitalization of the banking processes is just a small step in this journey. Banks will have to be open and leverage the power of technologies such as artificial intelligence, robotic process automation etc. to deliver the customer experience of tomorrow. Human intervention will be limited and there will be limited need for people to do basic tasks.

In the ‘bank of tomorrow,’ customers and banks can sit back and relax as robots and algorithms focus on providing the best customer experience catered to the unique needs of each customer.

Some banks have already started leveraging technology in novel ways. For example, Ally Bank has started using Alexa for its basic banking services[6].

Technology will also help banks to scale up customer service without increasing the need for resources.

In short, the customer experience of tomorrow will mostly be about technology. It means that the customer experience will be delivered mainly through robots, chatbots and interactive intelligent systems which will understand the human needs!

Let us also point out that this does not mean that the importance of human interaction in different customer touchpoints will be reduced to zero. The human element in customer experience is what has helped banks achieve the trust it commands. As Eran Westman points out, ‘the long-standing foundations of many consumer-facing businesses (such as banking, for example) are built on personal, face-to-face relationships. Today, though, customer engagement is becoming increasingly self-serviced and transactional[7]. In fact, as per a survey by inContact, 67% people prefer agent assisted customer service than self-service[8].

The importance of humans in providing customer experience will not diminish. Technology will further enable humans to provide a greater customer experience. While we cannot say that jobs will not be lost, we can be confident that more jobs will be created with the inflow of technology.

In the next part of our article, we will discuss on the importance of putting customer at the center and providing both tangile and intangible values to give the utmost personalised experience.

References:

[1] What is Customer Experience? https://www.forbes.com/sites/blakemorgan/2017/04/20/what-is-customer-experience-2/#466ed62a70c2

[2] The US Customer Experience Index, 2018 https://www.forrester.com/report/The+US+Customer+Experience+Index+2018/-/E-RES142377

[3] Forrester’s US CX Index 2018: Ranking of Banks https://www.forrester.com/report/The+US+Customer+Experience+Index+2018/-/E-RES142377#figure6

[4] Google Duplex really works and testing begins this summer https://www.theverge.com/2018/6/27/17508728/google-duplex-assistant-reservations-demo

[5] How Smart Speakers Are Poised to Reinvent the Travel Industry https://hbr.org/2018/08/how-smart-speakers-are-poised-to-reinvent-the-travel-industry?utm_medium=email&utm_source=newsletter_daily&utm_campaign=dailyalert_not_activesubs&referral=00563&deliveryName=DM11589

[6] Big banks hope early bet on Alexa will pay off https://www.americanbanker.com/news/banks-add-alexa-skills-to-develop-voice-command-services

[7] Keeping the Human Element in Digital Customer Experience https://www.entrepreneur.com/article/295567

[8] inContact Survey Reveals 67 Percent of Consumers Prefer Agent-Assisted Customer Service https://www.businesswire.com/news/home/20170522005560/en/inContact-Survey-Reveals-67-Percent-Consumers-Prefer