Kiran Jagannath agreed with the need to reduce complexity and stressed the fact that data volume and complexity are increasing at an unprecedented pace. Most organizations today are struggling to not just store, and integrate data across silos, but also analyze it effectively for intelligent, usable insights. Leveraging data effectively is crucial for wealth management. He gave the example of a leading private bank in India that was finding it difficult to collect data from internal and external systems and then process it for meaningful insights. AWS worked with the bank to create scalable data warehouses and bottomless data lakes. Services like AWS Glue were then used to bring all the data together, move and replicate it across multiple data stores. Once this was in place, Amazon Athena was deployed to process and analyze the data and derive usable insights. The bank was able to analyze data in real time and use the insights to build a consistent experience across channels. Cross-selling and upselling were based on customer behavior and deduced from real-time transactional data on their credit cards. The bank was able to reduce fraud and improve customer experience substantially.

Banks now must strike a balance between securing data, meeting customer expectations about tracking and traceability and ensuring compliance with regulations on pricing transparency. For example, regulators in Hong Kong and Singapore now demand proper controls and disclosures pertaining to pricing transparency and customer protection. Balancing all these requirements is not impossible if some changes are made. Banks need to establish better relationship-based pricing strategies and governance to establish a solid foundation that integrates pricing, compliance, and operating models. Unfortunately, many banks still make bare minimum investments in this area. Stop-gap solutions will not work anymore and strategic investments in state-of-the-art pricing software combined with process optimization can ensure effective revenue management and long-term profitability.

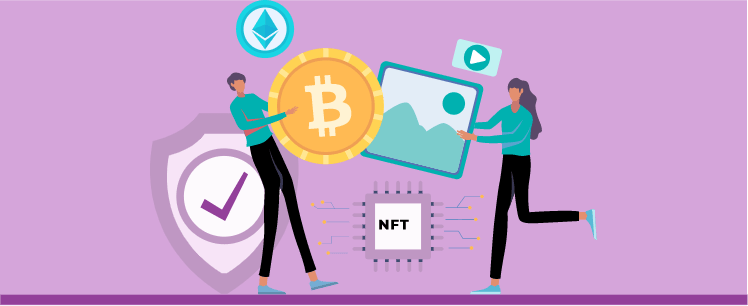

Digital class assets like cryptocurrency and NFTs are already seeing wide adoption and bring with them a whole new set of challenges. Volatility, unpredictability, and security are some of the concerns surrounding digital class assets. But these offer banks a good opportunity to deliver highly differentiated value propositions. This space is growing rapidly and going mainstream, but the pattern of growth and evolution is still fluid, and banks need to be able to observe and move quickly to capitalize on opportunities within this space. Technology will continue to play an important role in digital class asset management. And the role of technology will be to simplify and democratize new digital assets as they come in. The process of pricing governance will also change considerably. Earlier pricing would be decided by a pricing committee, and it was a time-consuming process that did not leave much scope for flexibility or agility. This approach will not work in the new era of digital class assets that exist, change, and evolve in real time. Clinton Abbot stressed the fact that banks must be able to quickly assess information and come up with relevant, personalized pricing in real time. Even seemingly irrelevant information can prove useful, he said, giving the example of a bank that used local weather information to deal with huge crowds at their branches by offering attractive relevant pricing discounts and offers.

Assets under Management (AuM) in the Asia Pacific are expected to double from USD 15. 1 trillion in 2017 to USD 29.6 trillion by 2025.1 But the truth is, only about 20 percent of the total wealth in this region has been tapped into by the wealth management industry.2 Majority of holdings in the region are still in the form of cash and deposits. Banks today are hard-pressed to drive profitability amidst increasing regulatory pressures and a lack of differentiated offerings. Right now, they must focus on delivering a highly differentiated proposition coupled with speed of advice, ability to respond swiftly to market opportunities and managing costs. Digital transformation journeys in banking hold the key to better wealth management practices and wealth maximization in high-net-worth markets like the Asia Pacific. Better data storage and handling to ensure trustworthy high-quality data coupled with quick real-time analysis for usable insights can unlock new possibilities for wealth managers in the coming years. Hyper-personalization in real time is what is moving the world and banks must work on delivering this effectively. At the same time, they must find effective ways to take people on this digital transformation journey – wealth managers, and customers alike.